- Chuck Mischley | Panelist, Director of Talent Acquisition at Nationwide

- Emily Platt, CFP® | Panelist, Assistant Vice President, Investments, at Wealthspire

- Kate Mielitz, Ph.D., AFC | Panelist, Special Programs Manager at the Association for Financial Counseling and Planning Education (AFCPE)

- Luke Dean | Moderator, Professor at Utah Valley University, and co-author of the 12 Tribes of Financial Planning Model

The panelists shared what attracted them to their specific tribe within the advisory careers sector of the model, along with what’s kept them excited about their career path over the years. If you couldn’t make it, we’ve recapped some of the main takeaways below.

What attracted you to your tribe, and why have you stayed?

In the 12 Tribes of Financial Planning model, there’s a grouping of tribes that includes advisory careers, such as registered investment advisors (RIAs), accounting and tax firms, counseling, government, academia, and research.

According to the model, this group is excellent for people-persons, project managers, and operators due to the attributes of advisory careers.

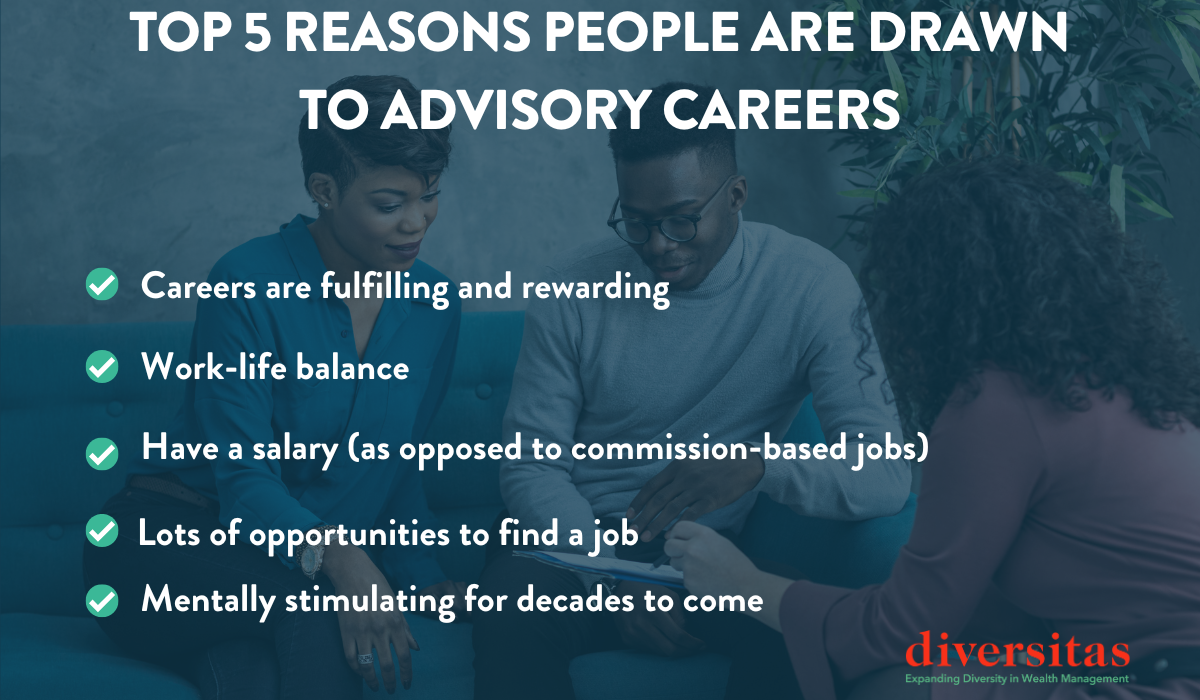

Although the panelists occupy different tribes within this group, they listed many of the common attributes of this sector as reasons they were attracted to it, such as:

- Having a passion for serving others

- Salaried position with a defined career path

- Knowing you make a difference in people’s lives

Dr. Dean confirmed that the top reasons people are drawn to advisory careers are that these careers are fulfilling and rewarding, have a salary (as opposed to commission-based jobs), there’s work-life balance, there’s opportunity to find a job, and they are mentally stimulating for decades to come.

What are the downfalls of your tribe?

In light of being fully transparent, the panelists discussed challenges in their career paths, although the positives heavily outweigh the negatives.

For Kate’s tribe of financial counseling, she said there’s not a huge paycheck, although there are opportunities to use your AFC designation to increase the impact of your compensation.

Chuck said it might not be a career for those who are more introverted and prefer to avoid being in front of people.

“We work with a select group of clients — the high-net-worth and ultra-high-net-worth clients — so we are missing a segment of the population who really could use the financial literacy, which was a concern I shared when I came into this role,” Emily said, noting that not all RIA roles will face this challenge.

“When I came in with that concern, that’s when I realized I still have flexibility and can do the pro-bono work with great organizations like Advisers Give Back, Savvy Ladies and other organizations that help individuals who are looking for financial guidance,” Emily said.

Why is this such a great career for women?

The panelists discussed the need for gender and racial diversity within their tribes, highlighting a few takeaways, including:

- Clients want to work with people who understand their differences and unique needs.

- The more we can have diversity as advisors or as people representing the financial services industry, it can only improve the way we service our clients.

- The flexibility in this career path is great for working parents or those with other family obligations.

What is the most important characteristic a job candidate should have in an advisory career?

The panelists shared specific traits new professionals should have if they want to join an advisory career, including:

- Being intellectually curious: Are you willing to learn? In this industry, the more you learn, the more you realize there’s more you don’t know.

- Putting the client first. Successful advisors always remember that living, breathing humans are on the other side of these decisions.

- It is being able to have that conversation with someone and having the desire to want to help people.

As Dr. Dean put it, you were meant to be in this profession if you have a big heart and a sharp mind.

To watch the entire session, please click here. If you’re looking for an internship, check out the Careers tab on our website, and stay in touch with us to hear about upcoming events and opportunities!