For those seeking a deeper dive, the full session is available for viewing here.

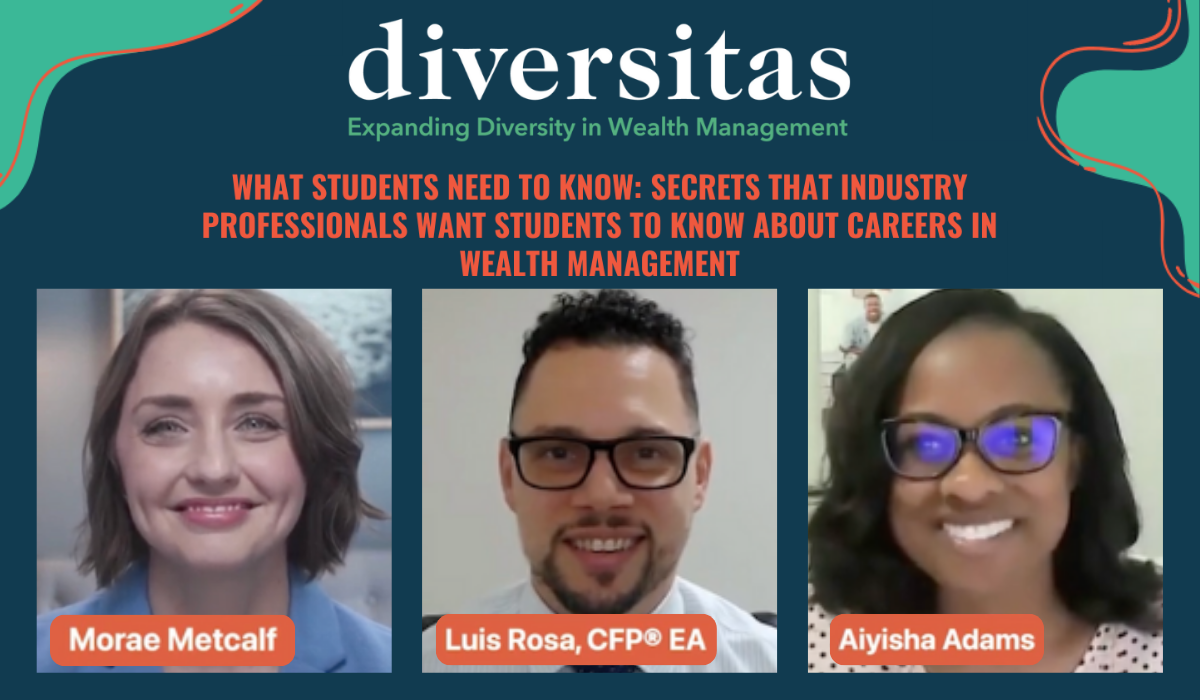

Before we share key takeaways from the session, meet the moderator and panelists:

- Aiyisha Adams, Vice President – Advisor Engagement, Osaic (Moderator)

- Morae Metcalf, AVP – Human Resources, Cambridge (Panelist)

- Luis Rosa, Founder-Financial Planner, Build a Better Financial Future LLC (Panelist)

Journey to Financial Services: Overcoming Challenges

Luis Rosa, the founder of Build a Better Financial Future LLC, faced many obstacles early on in his career. Having grown up in the Dominican Republic, he immigrated to America and not only learned how to speak English but also was tasked with learning the American financial system. In college, his school did not have a financial planning program, nor did he know anything about stocks or bonds, despite being an economics major. To overcome these struggles, Luis taught himself. He devoured books on personal finance and the stock market. Once Luis started working in the field, he found sitting in on client meetings to be incredibly valuable, as he was able to observe the advisor/client dynamic up close.

Similarly, to Luis, Morae Metcalf, AVP at Cambridge, went to college for business and found her passion for helping people thrive in whatever environment they are in. This led Morae to human resources where she had a few jobs before joining Cambridge and entering financial services.

“Finding a mentor and seeking opportunities to create an open space for questions and learning opportunities is really what helped me initially overcome that challenge of entering a new industry,” says Morae.

Successful Skills and Education Backgrounds in Wealth Management

When discussing what skills are useful to be successful in wealth management Morae emphasized the significance of two crucial skills, technical and soft skills. The first involves technical proficiency in comprehending market dynamics and financial intricacies, while the second skill, equally vital, encompasses soft skills such as relationship management, salesmanship, and coaching. In the realm of financial services, establishing trust with clients is paramount, and honing these skills is instrumental in cultivating enduring client relationships.

Luis also emphasized the importance of soft skills. “We find that you can always teach someone technical skills, whether it’s financial planning or software.” For financial planning specifically, it is a people business, and having good listening skills is crucial. Luis suggests to “be more interested than interesting.” He suggests speaking about yourself less, and asking more questions about the clients, learning about their story and what moves them to best help them and their finances.

Examples of Successful Professionals in Non-Finance Backgrounds

When Aiyisha Adams first graduated, she was a middle school teacher for special education. She assumed that because she loved kids she would love the field of teaching. However, she found that it was not the place for her. When she tried to decide what she wanted to do, she looked at the paper for job postings, and E*TRADE Financial was hiring. Despite having no financial knowledge, she got the job and was put through education to receive her Series 7 and other certifications. She learned that she loved to train adults and now, years later, she is the Vice President of Advisor Engagement at Osaic. Despite starting as a teacher of children, she found her love of teaching for adults.

One of Morae’s favorite stories is of Cambridge CEO Amy Weber. Weber had big dreams of being a corporate attorney in New York City. However, she got an internship in college at a brokerage dealer and found a love of the business and building relationships with people to help achieve their goals.

“We talk about accounting and math and these skills are important, but our business is about people and helping them achieve their financial goals and financial freedom,” says Morae.

Work-Life Balance in Wealth Management

“Through my research, I found that Gen Z and the Alpha Generation really value a work-life balance,” says Aiysha.

In wealth management and financial planning, professionals have a chance to balance work and personal life effectively. Flexible scheduling and remote work options enable individuals to manage their responsibilities, nurturing a healthier work-life equilibrium.

As a business owner, Luis acknowledges the genuine challenge of maintaining a work-life balance. Nevertheless, he has developed effective strategies to achieve it. One such approach involves having separate phones and phone numbers for work and personal matters. By silencing his work phone over the weekend, he can disconnect entirely from job-related concerns. This practice has allowed him to be more present in his personal life, reducing distractions from work or client scenarios.

“It’s helpful to write stuff down or journal to get it off my head but not forget it and then look back at it on Monday,” says Luis.

Luis has discovered the effectiveness of time blocking, recognizing that without it, he tended to neglect his schedule and personal needs, such as going to the gym, whenever work demands arose. By color-coordinating his calendar, he now prioritizes his day more effectively, ensuring he allocates time for what truly matters.

For Morae, achieving balance involves prioritizing non-negotiables and seeking alignment with a company’s values. At Cambridge, there is a strong presence of women in leadership that share an understanding of having a family and other demands outside of the workplace and boundaries set of when you are available and when you are not.

“Set expectations of when you will or will not be available and if you are okay with missing a basketball game or a school play and set those expectations and have open and transparent communication with your leadership and you will find ways to find that balance,” says Morae.

What has helped Aiyasha is delegating, “You can have it all but not at the same time. Whether you have someone to help clean, send laundry out or use meal services like Hello Fresh, it’s important to find things that help take the pressure off and create a balance that works for your needs.”

Salary Progression and Upward Mobility in Wealth Management

“We are currently in a unique position because we are in the biggest wealth transfer in history, with trillions of dollars being transferred from the baby boomers to the younger generations,” says Morae.

This means that we have new expectations about technology, accessibility, and availability of information. As new people enter the field, there are endless possibilities for the profession of one’s salary and upward mobility in their field because of unique perspectives and creative problem solving and critical thinking. These skills allow new people entering the field to have better understandings of how to help the new generations and find new opportunities for serving diverse groups that now manage wealth. All of this will be different based on your job function and location, but the opportunities are endless.

Fulfilling Aspects of Wealth Management

There are many aspects of wealth management that are extremely fulfilling for both the client and the professional. Before becoming the Vice President of Advisor Engagement, Aiysha was a retirement consultant where she had clients in education and the medical field. One example of how she made an impact was with a client who was getting ready to retire. Aiysha found a specific strategy for this client that would help her retire with longevity. The client was so grateful, and Aiysha received job satisfaction from being able to truly change someone’s life.

Morae’s fulfillment also comes from helping her clients achieve their goals and financial freedom. “Financial planning is more than opening accounts or recommending a portfolio; it’s about thinking about the bigger picture and having them save money for their children,” she says.

“I work with many first-generation wealth creators, individuals like me who may be the first in their families to graduate college and build wealth. Despite lacking financial expertise, with our guidance and resources, they can reach their goals. Seeing their tears of joy when we help them retire earlier, buy a home, or fund their child’s education without burdensome loans is incredibly rewarding,” says Luis.

To watch the full session, click here, and don’t forget to connect with these experts on LinkedIn.